- FTSE 100 index closes down

- US markets a sea of red

- Jonathan Jones has reportedly resigned as head of the UK governments legal department

5pm: Footsie closes in red

FTSE 100 index closed a shade lower on Tuesday as the tech sell-off in the USA continued.

Britain's blue-chip benchmark finished down around seven points, or 0.12%, at 5,930.

On Wall Street, the Dow Jones lost over 493 points, while the Nasdaq plunged over 313 points.

"European equity markets are deep in the red this afternoon as the continued weakness in US markets and the rise in tensions between the Trump administration and China has hurt confidence," noted David Madden, analyst at CMC Markets.

"Stocks in Europe had free rein yesterday as the US exchanges remained closed because it was Labour Day. The weakness that we saw in big US tech names last week, is still in play, and that is driving sentiment over here."

US and Canada 11.30am EST/4.30pm

Wall Street benchmarks were deep in the red on Tuesday, with the Dow Jones Industrial Average down over 438 points at 27,6945. The broader-based S&P 500 index shed around 65 points at 3,636. The technology stock laden Nasdaq exchange plunged over 286 points at 11,026. In Toronto, the TSX shed over 86 points at 16,131.

11am EST: Proactive North America headlines:

Karora Resources Inc (TSE:KRR) reveals early success in expanding mineral resource base at Beta Hunt mining complex

Biocept (NASDAQ:BIOC) (FRA:B002) inks deal to make its Target Selector cancer assays in-network for 3M US military members, their families

Mirasol Resources Ltd (CVE:MRZ) (OTCPINK:MRZLF)inks definitive option agreement for its Nord project in Chile

Gevo Inc (NASDAQ:GEVO) (FRA:ZGV3) says it now has the financial resources to execute on strategy as it looks to close a project financing in next 12 months

Duos Technologies Group Inc (NASDAQ:DUOT) wins $1.3 million contract from Class 1 railroad operator

Phunware Inc (NASDAQ:PHUN), launches enhanced mobile loyalty and engagement features for its Multiscreen-as-a-Service (MaaS) customers worldwide

Willow Biosciences (TSE:WLLW) (OTCQX:CANSF) (FRA:3D7) set for Canada government funding to help advance its rare cannabinoids program

Co-Diagnostics Inc (NASDAQ:CODX) (FRA:C97) to expand COVID-19 testing services by Arches Research using its Logix Smart test kit

PreveCeutical Medical Inc (CSE:PREV) (OTCQB:PRVCF) (FRA:18H) pleased with rodent model of opioid substitute pain-reliever

Mawson Gold Ltd (TSE:MAW) (OTCPINK:MWSNF) bolsters team in Finland as it eyes resource update for Rajapalot

3.45pm: Sterling down in the dumps

If it is any consolation, the Footsie may be in the red but it is faring better than most European indices.

Londons index of blue-chip shares was down 37 points (0.6%) at 5,900, helped by sterlings continued weakness on foreign exchange markets.

The pound has fallen by well over a cent to US$1.3049 against the greenback while against the euro it is down by just under a cent at €1.1062.

“Entirely as we thought might happen this week, the pound has found itself at the mercy of negative reporting around Brexit,” said Neil Wilson at markets.com.

“GBPUSD dropped sharply to hit its lowest since August 25th, extending losses after a weak open to test support under 1.3060 amid reports that the head of the UK governments legal department has quit over Boris Johnsons plans to rewrite the withdrawal agreement. Whilst we should caution that this indicates disharmony, it is also possibly an overreaction by the market to a negative headline, and does not necessarily make a deal with the EU less likely than it was before,” Wilson said.

"A contempt for law and proper process often brings short-term gains at the cost of wider problems." @davidallengreen on the resignation of Jonathan Jones. https://t.co/658RiMkav5 via @financialtimes

— Siona Jenkins (@SionaJ) September 8, 2020

“Nonetheless it highlights the brinkmanship pursued by Johnsons government in the talks – even suggesting that Britain could unilaterally rewrite the withdrawal agreement has raised the EUs hackles and clearly raises the stakes as the two sides commence the 8th round of official talks today. Expect more negative headlines, more risk and more volatility. A positive surprise seems increasingly unlikely, but for this reason would be all the more dramatic should it emerge and produce a sharp reversal for GBP,” Wilson said.

Meanwhile, a call has gone out for the last senior civil servant to leave the building to turn out the lights.

2.43pm: Wall Street opens on the back foot

The main Wall Street indices opened in negative territory on Tuesday at the start of a shortened week as traders seemed to be less optimistic following the Labor Day weekend.

Shortly after the opening bell, the Dow Jones Industrial Average was down 1.56% at 27,693 while the S&P 500 slipped 1.89% to 3,362 and the Nasdaq slumped 3.33% to 10,936.

The tech-dominated Nasdaq has been weighed down by a continuation of heavy selling of tech stocks that characterised last weeks rout, with electric car firm Tesla Inc (NASDAQ:TSLA) suffering particularly badly, tumbling 15.6% to US$353 after the stock was snubbed by the S&P 500 index.

Comments from Donald Trump that he may seek to decouple the US economy from China also seem to have rattled markets as the spectre of a trade war once again rears its head.

Back in the UK, the FTSE 100 had slipped further into the red and was down 61 points at 5,876 shortly before 2.45pm.

2.00pm: Never mind 6,000; the Footsie has sunk below 5,900

No sign yet of a rally by the Footsie; in fact, it has been retreating down the hill.

Londons index of heavyweight shares, which this morning looked as if it might have a decent shot at regaining the 6,000 level, has fallen below 5,900 to 5,885, down 52 points (0.9%).

Scottish Mortgage Investment Trust PLC (LON:SMT), which thanks to its chunky holdings in US tech giants is one of the easier ways for UK investors to gain exposure to the fluctuations of the USs tech-heavy NASDAQ index, was prominent among the fallers, down 3.6% at 863p.

Aerospace-related stocks are also out of favour, as fears grow of the second wave of coronavirus cases getting out of hand.

Rills-Royce Holdings PLC (LON:RR.) was off 4.5% at 215.4p and GKN owner Melrose Industries PLC (LON:MRO) was 3.6% lower at 117.9p.

12.30pm: US investors hesitant to return to the market after the long weekend

After the long weekend in the stateside, US investors hoping for a resumption of upward momentum may have to wait a bit longer.

Spread betting quotes indicate that even the gravity-defying NASDAQ Composite will open lower, at 11,272 (down 41 points).

The Dow Jones average is expected to retreat 60 points to 28,073 and the S&P 500 is tipped to shed 32 points at 3,395.

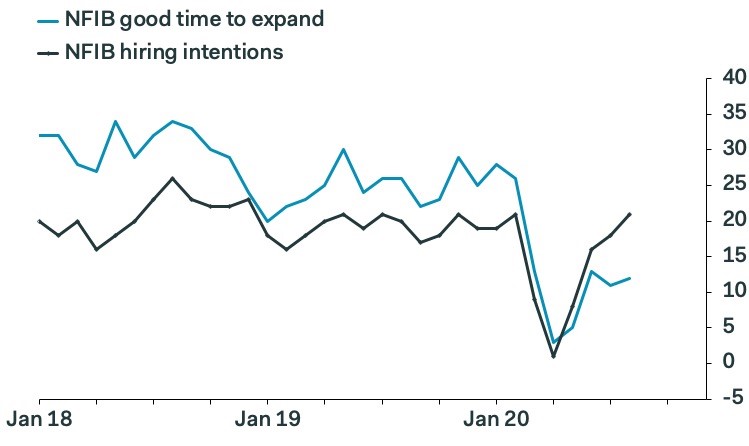

The recent stonking gains – particularly on the NASDAQ – have been driven by the mega-large technology stocks but early-morning focus across the pond has been on small businesses, with the NFIB Small Business Optimism Index climbing to 100.2 in August from 98.8 in July.

Economists had expected a reading of around 99.0.

“The uptick in the headline is due mostly to increases in earnings expectations, up seven points, and the key labour market components, which were released last week ahead of the official payroll report, as usual,” explained Ian Shepherdson, the chief economist at Pantheon Macroeconomics.

“Hiring plans and jobs-hard-to-fill both rose by three points, and the former has now returned to its February pre-COVID level, 21. This is impossible to square, however, with the Homebase small business employment data, which show that payrolls in the sector have been falling outright since mid-August. We accept that the small business sector is in a state of flux, but the Homebase data come from a much bigger pool of firms than the NFIB sample, and have been a good guide to the official payroll numbers in recent months,” Shepherdson noted.

Back in Blighty, the Footsie remains in arrears, down 22 points (0.4%) at 5,915.

11.10am: Backsliding by the Footsie

Its all gone a bit pear-shaped for Londons blue-chip equities in the second half of the morning trading session.

The FTSE 100 was down 29 points (0.5%) at 5,909 despite sterling shedding more than a cent against the US dollar; a weak exchange rate is normally reckoned to be good for Footsie stocks but that particular Elastoplast is not doing the job this morning.

Housebuilders are prominent among the big-name losers, after a disconcerting trading update from building materials flogger Travis Perkins PLC (LON:TPK0.

The builders merchant saw its shares dive 8.2% to 1,119.5p after it reported a 20% fall in first-half revenue to £2.78bn from £3.48bn the previous year. The board is not recommending an interim dividend payment.

Among the housebuilders, Persimmon PLC (LON:PSN) was the worst performer, shedding 4.4% at 2,453p while Barratt Developments PLC (LON:BDEV), The Berkeley Group Holdings PLC (LON:BKG) and Taylor Wimpey PLC (LON:TW.) all suffered falls of more than 2%.

Its not been a good month for the housebuilders so far with Barratt, Persimmon and Taylor Wimpey getting a slap on the wrist last week from the Competition & Markets Authority for so-called ground rent “fleeceholding” practices.

At the happier end of the Footsie leader-board, packing giant DM Smith PLC (LON:SMDS) has supplanted JD Sports as the top riser, with a 7.7% gain to 293.9p on the back of its trading update ahead of todays annual general meeting (AGM).

The companys decision to resume dividend payments is likely to be a (virtual) crowd-pleaser at the AGM.

$SMDS DS Smith says it will pay an interim dividend as trading has improved https://t.co/exMdL7yssA via @proactive_UK @dssmithpack #SMDS

— Proactive (@proactive_UK) September 8, 2020

“DS Smiths intention to pay an interim dividend is somewhat unclear given that conditions have not dramatically improved since the previous decision not to pay one,” said a puzzled David OBrien at Irish stockbroker, Goodbody.

“The backdrop remains difficult given that the pricing environment has deteriorated further over the last two months and we have seen a spike in COVID cases in Europe. The pricing cycle also continues to be uncertain given the surge in container-board capacity growth in Europe in the next 6-18 months. Nonetheless the stock has responded well to the clarity provided on the dividend, even if the outlook remains uncertain,” he noted.

9.40am: Sterling still being used by forex dealers as a doormat

The pound is still being tossed around on foreign exchange markets like a rag doll, which continues to provide some support for blue-chip equities.

Having said that, the FTSE 100s ascent is a bit like an old banger going up a 1-in-6 hill; the index was up just 14 points (0.2%) at 5,951, despite sterling shedding another two-fifths of a cent against the US dollar.

Sterling will now buy you US$1.3126.

It is down by a similar amount against the euro; the exchange rate is now hovering around €1.1107 as forex traders react to the latest posturing in the Brexit negotiations.

“The pound dipped 0.2% against the dollar and euro alike, sterling continuing to give up ground as Boris Johnson guns down the remaining cordiality between the UK and EU. It is perhaps surprising that the pound didnt open even lower, given that the relationship between both sides seems to be fast approaching a fresh nadir,” said Spreadexs Connor Campbell.

There was a bit of cheer for retailers as the British Retail Consortiums (BRC) measure of year-on-year growth in retail sales rose to 3.9% in August from 3.2% in July.

Excluding those months in which the moveable feast that is the Easter holiday distorted the figures, this was the biggest increase since May 2018, according to Samuel Tombs, the chief UK economist at Pantheon Macroeconomics.

Tombss theory is that there are more UK shoppers around because foreign holidays are off the agenda for many of us.

“The BRCs data usually are a good guide to the official figures, though they might be slightly too upbeat this month. Its figures correlate best with the official measure of sales by large retailers; sales by small retailers already were up a huge 13% year-over-year in July, so look vulnerable to slip back. In light of this, we judge that total sales volumes were little changed from Julys level in August,” Tombs said.

“Note too that households still appear to be willing to spend more on goods than services; Barclaycard reports that total spending merely was 0.2% higher than in August 2019. Meanwhile, we continue to expect retail sales to slip back in the autumn, as labour income declines with the withdrawal of government support and the accumulation of redundancies, and the temporary support from pent-up demand and the summer staycationing boom fades,” Tombs said.

Retail sales jumped last month as shoppers spent more money online – but city centre shops and bricks & mortar fashion retail continue to struggle, according to the latest figures from @the_brc #retailsales #ukretail #retailnews #highstreets https://t.co/iZjI9uhmeE pic.twitter.com/z5mpeef8oO

— TheIndustry.fashion (@theindustryfash) September 8, 2020

On the subject of retailers, JD Sports Fashion PLC (LON:JD.) topped the blue-chip risers with a gain of 7.0% at 775p after its interims.

“In the last decade or so JD Sports has been the star turn in the retail sector. It has shown its rivals a clean set of heels as it identified and targeted a youthful demographic with disposable income and tapped into the athleisure trend of wearing trainers and tracksuits to socialise, work and work out,” said AJ Bells investment director, Russ Mould.

“What comes after the current financial year is open to question. Part of its target market could be vulnerable to unemployment, particularly assuming the furlough scheme in the UK ends as planned in October but with the companys clear retail expertise and a very strong balance sheet it should be a sector survivor,” Mould opined.

8.50am: Further gains for Footsie

The FTSE 100 kicked off in positive territory on Tuesday ahead of make-or-break trade negotiations with the EU over Brexit.

Londons blue-chip share index opened 25 points to the good at 5,962.91. But it still remains stubbornly below the 6,000-mark having drifted 5% lower in the past month amid the reality of recession brought on by the coronavirus (COViD-19) pandemic lockdown.

With Michel Barniers team now in London, the war of words ahead of the Brexit showdown is suggestive talks could be feisty and short-lived.

From the continent, meanwhile, the economic news was provided reasons to be cheerful. Germanys exports rebounded, while in France, Insee, the national statistics institute, is forecasting the economy will contract by 9% this year rather than the 11% first predicted, with a rebound in activity expected in the second half.

On the market, JD Sports (LON:JD.) shot up 8% in early deals as the trainers and tracksuits group turned in a resilient half-time performance in which sales slipped just 7% as the result of lockdown.

“This is a remarkable performance given the circumstances,” said Michael Hewson of CMC Markets.

There was a trading statement-inspired bounce for DS Smith (LON:SMDS), the packaging group, which advanced 5%.

On the FTSE 250, Royal Mail (LON:RMG) jumped 12% despite warning it would make a “material loss” this year and advising that “substantial business” change was required to restore profitability.

Travis Perkins (LON:TPK) shares dropped 6.7% after it fell to a loss, dragging the builders, including Persimmon (LON:PSN) lower with it.

Proactive news headlines:

Kavango Resources PLC (LON:KAV) has published initial images of three-dimensional geological modelling developed from data obtained from the Kalahari Suture Zone project in south-western Botswana. The images confirm significant similarities between the northern Hukuntsi section of the KSZ and the giant Norilsk mining centre in Siberia. Norilsk accounts for 90% of Russia's nickel reserves, 55% of its copper and virtually all of its' platinum group metals. Kavango said it increasingly believes that Hukuntsi has the potential to host very significant copper, nickel and platinum group metal deposits.

Synairgen PLC (LON:SNG) shares opened strongly higher on Tuesday after it unveiled positive interim data from its phase II study of inhaled interferon beta drug for people with chronic obstructive pulmonary disease (COPD) that it said was also “supportive” of its coronavirus (COVID-19) programme. The analysis of SNG001 revealed it was well tolerated in this older population studied and that lung antiviral responses were “significantly enhanced”. The results thus far support the treatments progression for use with exacerbating COPD patients, where the symptoms have worsened and require treatment with an anti-inflammatory called a corticosteroid and/or antibiotics. Crucially, the data helped make the case for Synairgens COVID-19 programme. In the update, the company said it was in discussions with “a number of regulatory agencies worldwide” to establish a route to the approval for its drug as a treatment of the severe symptoms of the virus.

Gaming Realms PLC (LON:GMR) has told investors it increased revenue by 66% in the first half of 2020 to £5.2mln versus £3.1mln in the same period of 2019. The company said that the impacts of the coronavirus (COVID-19) lockdowns were supportive of the business, with more people playing its games, and the group noted that it has maintained similar levels of growth since June 30 as well. The firm, which makes and licences real money games, noted that it has high margin revenue growth and a relatively stable fixed cost base. Earnings for the first half amounted to £1.24mln, from a £0.1mln loss a year earlier.

Seeing Machines Limited (LON:SEE) said it has signed a memorandum of understanding (MOU) with a global semiconductor company as formal terms of engagement are finalised to licence its Occula Neural Processing Unit. The AIM-listed firm, which specialises in artificial intelligence (AI) powered operator monitoring systems, said the collaboration represented the third pillar of its recently announced embedded product strategy, which will see the company make Occula available for license as an application-specific integrated circuit (ASIC) to semiconductor companies for integration with any automotive computing platform. Occula is an accelerator designed for integration into ARM-based systems-on-chip to enhance the companys software and to support “ultra low-power human face, eye and body tracking”.

Silence Therapeutics PLC (LON:SLN) said it has received approval from the US Food and Drug Administration (FDA) for its Investigational New Drug (IND) application for SLN360. The FDA has given the go-ahead for Silence to start SLN360 dose-escalation studies in healthy volunteers and secondary prevention patients with elevated Lipoprotein(a). Silence hopes to start dosing healthy volunteers in the Phase 1 trial by the end of the year but acknowledged that the coronavirus (COVID-19) pandemic may affect timings. On the corporate side, Silence announced, separately. that the US Nasdaq exchange has approved the listing of the companys American Depositary Shares (ADS) and trading can start from today.

Digitalbox PLC (LON:DBOX) has reported sharply reduced losses in its first half after the media group said its performance had exceeded its expectations despite “difficult conditions”. For the six months to June 30, 2020, the owner of the Daily Mash and Entertainment Daily websites reported a pre-tax loss of £102,000, narrowed from a £713,000 loss in the prior year, while revenues climbed by 38% to £1mln. The company said growth in website traffic and revenues in the first quarter of its current year had offset the impact of the coronavirus pandemic in the second quarter, with the Daily Mash, in particular, seeing record traffic during lockdown as UK users spent more time online.

Newmark Security PLC (LON:NWT) told investors that its Safetell subsidiary has landed two new contracts with two existing clients. One client, a multinational financial services company, has inked a two-year contract for security and asset protection systems across a nationwide branch network (over 500 locations) and it is worth around £1.3mln. The other, with a UK building society, is a three-year contract for auto doors located at branch entrances. It is worth an estimated £400,000.

Arix Bioscience PLC (LON:ARIX), the biotech companies backer, saw its net asset value (NAV) per share improve markedly in the first half of 2020. Arix said its NAV had risen to £251.0mln by the end of June 2020 from £202.1mln at the end of 2019. NAV per share jumped 24% to 185p from 149p, the company revealed in its interim results. The group's gross portfolio value climbed to £203.4mln from £149.2mln at the end of 2019, driven by good clinical and financial progress by its portfolio companies.

Shanta Gold Ltd (LON:SHG) said its new West Kenya project could contain a number of large, high-grade deposits with district-scale gold potential. The companys Kenya ground is situated on the northernmost greenstone belt in the Lake Victoria Goldfield, the Archaean Busia-Kakamega (ABK) belt. The licences on this belt “cover a greenstone gold district similar in size to the great Val d'Or District-Abitibi in Canada,” Shanta chief executive Eric Zurrin told investors in a statement.

Inspiration Healthcare Group PLC (LON:IHC) told investors it has sought permission to start trials for a respiratory device designed for use in neonatal intensive care. The technology for the device, referred to as Project WAVE, was acquired in 2018 by Inspiration under licence from a leading US west coast university. The technology was granted a patent in March 2020. An application has been submitted through the Integrated Research Approval System (IRAS), requesting to start the trial at the Trevor Mann Baby Unit, Brighton & Sussex University Hospital.

Advanced Oncotherapy PLC (LON:AVO), the maker of next-generation proton therapy systems, said assembly activities at its Cheshire facility have resumed. In an update, the company said it has received all bespoke and high precision accelerating structures for its game-changing LIGHT technology, adding that it was expecting the delivery of further supporting equipment in line with its completion plan. The company told investors that “clinical use discussions” were continuing with the University Hospitals Birmingham NHS Foundation Trust (UHB), the London Clinic and the Mediterranean Hospital ahead of the installation of their LIGHT systems.

Coinsilium Group Limited (LON:COIN) said it has successfully launched The Post Covid Hack, a global blockchain hackathon initiative organised in partnership with its portfolio company Indorse ltd. An online hackathon is a design sprint-like event, spread over several weeks, in which computer programmers and developers collaborate on software projects to create functioning software solutions by the end of the event. The blockchain advisory group said the objective of the Post Covid Hack is to mobilise and incentivise blockchain developers to build solutions to address social and economic issues emanating from the coronavirus pandemic. The hackathon, which has enlisted the support of over 60 partners, was launched in August with the opening of registrations and a series of pre-hackathon educational webinars.

In a separate statement on Monday, Coinsilium advised that a new special report on the company from Value The Markets has been published and is available in PDF form for download via the following link: Read More – Source

[contf]

[contfnew]

Proactiveinvestors

[contfnewc]

[contfnewc]