- FTSE 100 closes down 28 points

- US indices mixed

- IAG friendless as tourist shun London

5.15pm: FTSE closes down

FTSE 100 index closed lower on Monday, while US stocks were mixed, as nothing was able to lift the apparent investor malaise.

Britain's blue-chip benchmark closed down over 28 points, or 0.46%, at 6,261 as positive news on a potential pandemic vaccine did little to shift the dial, along with fears over future financial packages in Europe.

"Global markets have kicked off the week in a somewhat uninspiring fashion, with the FTSE 100 failing to gain ground despite a host of positive Covid headlines from AstraZeneca, Synairgen, and Pfizer," said analyst Joshua Mahony at IG Index.

"Sceptical performances throughout global indices have provided the perfect platform for further upside in the precious metal sector, with silver the biggest gainer as it topped $20 for the first time since 2016," he added.

Gold had a good day though, advancing 0.44% to US$1,817.80 an ounce.

US and Canada 4pm/11 EST

Wall Street stocks started mixed on Monday. The Dow Jones Industrial Average fell over 37 points at 26,634 but the tech-heavy Nasdaq exchange added over 159 at 10,662. In Canada, the S&P/TSX Composite index was up around 28 points at 16,151.

Proactive North America headlines:

American Resources Corp (NASDAQ:AREC) bolsters board with addition of financial industry executive

BevCanna (CSE:BEV) (OTCMKTS:BVNNF) signs deal to manufacture white-label CBD and THC-infused beverages for State B Beverage of British Columbia

WeedMD (CVE:WMD) (OTCQX:WDDMF) announces tie-up with CannTx Life Sciences to enhance its genetics bank and preserve its cannabis strains

NexTech AR's (CSE:NTAR) (OTCQB:NEXCF) InfernoAR virtual events platform chosen for international metals conference

GR Silver Mining (CVE:GRSL) (OTCQB:GRSLF) reports new high-grade drill results from its Plomosas silver project in Mexico

Silvercorp Metals Inc ((NSYEAMERICAN:SVM) (TSX:SVM) reports encouraging underground drill result from DCG mine being developed in Ying District

Loop Insights (CVE:MTRX) (OCTMKTS:VRZPF) inks memorandum of understanding with ImagineAR to establish combined platform

Perma-Fix (NASDAQ:PESI) says selected by US Department of Energy for 10-year waste clean-up contract team

Ipsidy Inc (OTCQB:IDTY) and technology consultant IECISA Perú sign agreement to deliver mobile facial biometric identity platform

MagicMed Industries unveils C$1.5 million offering to expand its molecular psychedelic derivatives portfolio

3.45pm: The Footsie makes another half-hearted attempt at a rally

After suffering a dip following the US open, the Footsie is making another effort at a modest rally.

The FTSE 100 was down 18 points (0.3%) at 6,272.

AstraZeneca PLC (LON:AZN) was the best performing blue-chip, up 2.8% at 9,255p, on the back of some promising developments on an experimental coronavirus vaccine.

The vaccine, which is being developed by Oxford University in collaboration with AstraZeneca, has proved safe with some signs of efficacy in its first human trial.

Elsewhere, Jonathan Roe, the chairman designate of controversial loans guarantor Amigo Holdings PLC (LON:AMGO), received a lukewarm welcome, with the shares slumping 23% to 7.49p.

Roe was until recently non-executive chairman of Vanquis Bank for three and a half years.

EXCELLENT News:

Oxford/AstraZeneca COVID vaccine could be here by Oct!

Phase 3 testing in 1000s of humans

Projected to be 80% effective in preventing severe disease

Pledged to produce 2 billion doses THIS YEAR!

Feeling good. This????is not false hope:)https://t.co/bMRRkjfkeB https://t.co/pjycWir2ke

— Faheem Younus, MD (@FaheemYounus) July 16, 2020

3.00pm: US indices on the back foot

US indices have opened lower, although for a while the tech-heavy NASDAQ Composite – not for the first time – went its own way.

The Dow Jones was down 23 points (0.1%) at 26,645 and the S&P was off 4 points (0.1%) at 3,221; the NASDAQ was practically unchanged.

Investors were cautious despite some encouraging trends on coronavirus cases over the weekend.

The Johns Hopkins database reported 61,800 new cases yesterday, which was just 4.8% higher than the 59,000 reported a week earlier.

“This is the third straight single-digit increase, well below the prior trend, just over 20% per week. The seven-day average week-to-week increase has dropped to 13.9%, the slowest rate since June 16,” observed Ian Shepherdson, the chief economist at Pantheon Macroeconomics.

“To be clear, the number of new cases per day is still rising in most states but the rate of increase — measured as the week-to-week change in the seven-day average — has slowed in 36 states over the past week,” he added.

In London, the FTSE 100 was 33 points lower at 6,257.

International Consolidated Airlines Group SA (LON:IAG), down 3.2% at 212p, was one of the bigger blue-chip fallers on the day when it was announced that London has fallen out of the top 10 of most popular holiday destinations in Europe; a year ago, the same survey had London at number one and according to travel research firm ForwardKeys, it is the first time London has dropped out of the top 10 in the surveys history.

Away from the big-caps, Synairgen PLC (LON:SNG) made its shareholders happy with the announcement of positive results from a clinical trial of its drug to tackle the severe symptoms of coronavirus (COVID-19).

The shares were up a mind-boggling 311% at 150p.

The progress on the science front to fighting COVID continues to be at like the 95th percentile of reasonable expectations, even as the political/societal response has, uh, not been.https://t.co/pDHdpiD6Ozhttps://t.co/swqjmK2Abp

— Nate Silver (@NateSilver538) July 20, 2020

2.15pm: US indices to open little changed

US indices are set to open little changed.

Spread betting quotes suggest the S&P 500 will open less than a point lower at 3,224 while the Dow Jones is expected to start at 26,647, down 25 points.

“European stocks and US futures are trading mixed ahead of a busy week which is filled with 78 earnings updates from the S&P 500 companies. This week is all about fiscal stimulus and it seems the EU will get their deal done, while Republicans and White House will settle on a $1 trillion proposal that will limit funding for virus testing,” said Edward Moya at OANDA.

The FTSE 100 was down 23 points (0.4%) at 6,267.

12.40pm: EU leaders reconvene to discuss assistance fund

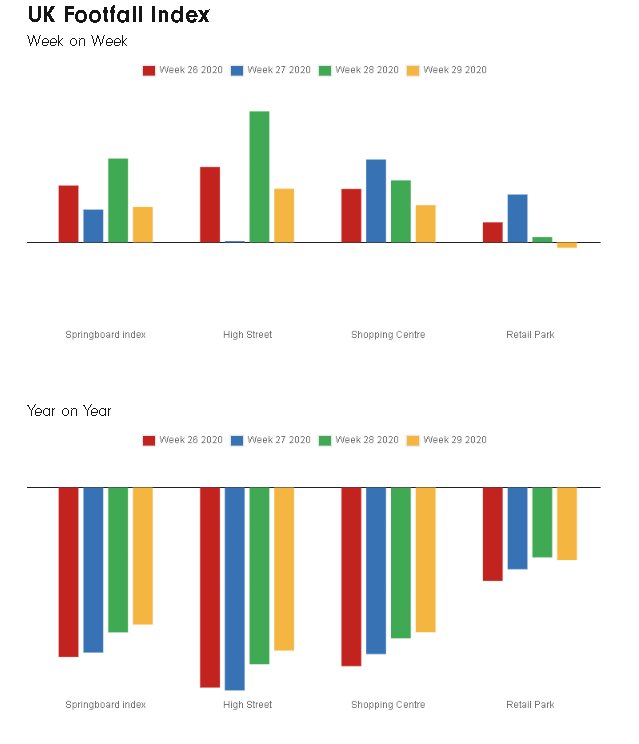

Britons are slowly rediscovering the shopping habit, according to the latest footfall report from the market research group, Springboard.

“Last week demonstrated that the longed-for flood of shoppers returning to bricks and mortar destinations and stores once again became a trickle, with a week-on-week rise in footfall that was less than half that in the previous week; however, the easing of restrictions in Scotland and Wales boosted footfall in these nations significantly, with double-digit increases in both,” Springboard reported.

“All of the increase in activity occurred in high streets and shopping centres, with footfall in retail parks declining marginally from the week before; however, despite the limited rise in footfall the gap between last year and this year lessened further, with an annual decline across the UK that is the most modest yet,” it added.

The survey came on the day that reports circulated of big job cuts at Marks and Spencer Group PLC (LON:MKS), the former FTSE 100 retailer.

According to a Sky News report, the retailer will unveil its redundancy plans within days, with several thousand jobs on the line as a restructuring plan is accelerated.

BREAKING: Marks & Spencer has announced plans to cut 950 jobs as part of a shake-up of its retail management structure.

Read more here: https://t.co/gex4rAxSpC pic.twitter.com/uo1zid3RqU

— SkyNews (@SkyNews) July 20, 2020

M&S shares were down 2.0% at 96.9p.

The FTSE 100 was off 32 points (0.5%) at 6,258.

11.45am: Mid-morning rally fizzles

The mid-morning rally has fizzled out and blue-chip equities have resumed their descent.

The FTSE 100 was down 44 points (0.7%) at 6,247.

“European equity markets are mixed as EU leaders are still divided over the terms of the €750 billion rescue fund,” reported CMCs David Madden.

“Traders shrugged off the fact that things appear to be heading in the right direction as the gulf between the two sides has narrowed. The original proposal was that €500 billion be distributed as grants, and the remaining €250 billion be issued as loans. A few northern European members, Austria, Denmark, The Netherlands and Sweden, were opposed to such a high proportion of grants being issued. The group have been called the frugal four, and they are keen for conditions to be attached to the grants,” he added.

There has been a bit of decent news for housebuilders with Rightmoves latest house price data.

The average price of property coming to market in Britain rose to a record high of £320,265, the property listings website said.

Average asking prices are now 2.4% higher than in March pre-lockdown, Rightmove added. The number of sales being agreed so far this month is also exceeding the prior years figures in England, Scotland and Wales.

“The busy until interrupted spring market has now picked up where it left off and has been accelerated by both time-limited stamp duty holidays and by homeowners reappraising their homes and lifestyles because of the lockdown,” declared Miles Shipside, described by Rightmove as its resident (as opposed to residential) property expert.

“The strength of buyer demand has contributed to record prices, with the 3.7% annual rate of increase being the highest for over three and a half years,” Shipside noted.

Housebuilders Berkeley Group Holdings PLC (LON:BKG) and Barratt Developments PLC (LON:BDEV) were prominent among those defying the trend, with rises of 0.8% and 0.7% respectively.

10.15am: Equities recover as household finances do likewise

The IHS Markit Household Finance Index (HFI) for July rose to 41.5 from 40.7 in June.

“The phased reopening across parts of the UK economy appears to have been a factor supporting household finances in July,” IHS Markit ventured in an analysis of the surveys results.

31% of the surveys respondents said their jobs were less secure than before the coronavirus pandemic hit the UK.

“Large numbers of households are therefore maintaining the cautious spending habits adopted during the early stages of the pandemic and are now focussed on paying down debt and saving where possible,” said IHS Markit director, Tim Moore.

The FTSE 100 was recovering from a dismal first hour of trading and was down just 14 points (0.2%) at 6,277.

8.40am: Weak start to new week

The FTSE 100 index made a dour start to the trading week, taking its cue from a lacklustre Monday session in Asia.

The index of UK blue-chips opened 20 points lower at 6,270.68.

Wrangling over the make-up of the EUs potential €750bn bail-out exerted a drag on sentiment, as did the UKs ballooning spat with China over Huawei and Hong Kong.

No doubting the big corporate news of the morning – though it came from an unlikely source.

Small-cap drug developer Synairgen (LON:SNG) looks to have discovered a life-saving treatment for acute cases of coronavirus (COVID-19).

It said the results from a recent trial “could signal a major breakthrough in the treatment of hospitalised patients”.

The shares soared 193% early on to 107p. Mark Brewer, an analyst at finnCap, has increased his price target for the stock to 360p.

He noted that quantifying the coronavirus opportunity was “nigh on impossible” as he admitted the valuation “could go substantially higher”.

What happens next will depend on the “upcoming discussions with regulators, which should clarify the route to market and the potential for buying SNG001 ahead of the winter 2020 flu season and the possibility of a second wave of COVID-19”.

Sticking with the sector, and the medical area, AstraZeneca (LON:AZN) edged up 3.7% ahead of the publication in the Lancet medical journal of phase I results from its vaccine collaboration with the University of Oxford.

On their way down were the travel stocks. British Airways owner IAG (LON:IAG) lost 2.8% and InterContinental Hotels Group (LON:IHG) was down 2.5% amid worries over a coronavirus second wave.

Proactive news headlines:

Synairgen PLC (LON:SNG) chief executive Richard Marsden said positive results from a clinical trial of its drug to tackle the severe symptoms of coronavirus (COVID-19) “could signal a major breakthrough in the treatment of hospitalised patients”. People who received SNG001, an inhaled formulation of interferon beta had a 79% lower risk of developing a severe disease compared to those given the placebo, the data revealed. They were also more than twice as likely to recover from the illness than those receiving the substance with no therapeutic value. A total of 101 people took part in the clinical assessment at nine sites between March 30 and May 27.

Touchstone Exploration Incs (LON:TXP) Cascadura project has been confirmed as a significant discovery in a new independent reserves report. Consultant GLJ Ltd has estimated Cascadura hosts between 241.2 and 571.5 billion cubic feet of discovered natural gas in place, with the best estimate pitched at 398.5bn. GLJ gives the project some 73,19mln barrels of oil equivalent (boe) reserves in the 3P (proved, probable, possible) category, with 2P (proved and probable) reserves set at 45.03mln boe and theres 23.62 boe of proved reserves. The reserves are valued by GLJ in a range between US$802.9mln and US$287.7mln, with 2P reserves valued at US$519.2mln.

Shanta Gold Ltd (LON:SHG) produced 22,216 ounces of gold from its New Luika mine in Tanzania during the second quarter of 2019, up on the 20,167 ounces produced in the first quarter. Free cash flow amounted to US$15.5mln, up from US$3.9mln in the first quarter. The company said it has also been working up the resource at Singida, which now stands at 243,000 ounces.

ReNeuron Group PLC (LON:RENE) said a decision to focus in-house activities on its retinal disease and exosome-based programmes will provide “significant near-term opportunities to deliver value-enhancing data and commercial partnerships” as it updated on the progress of its various treatments. In its results for the year ended March 31, 2020, the cell-based therapeutics firm said its hRPC stem cell therapy candidate for the retinal disease had delivered “positive and sustained top-line efficacy data” in an ongoing US Phase 1/2a clinical trial, with further readouts from an expanded study expected over the next 12 months, leading to intention to file an application in the second half of 2021 to commence a pivotal clinical study. The company also said it has received regulatory approval in the US and UK to expand the Phase 2a study to allow for a subsequent potential single pre-approval clinical study and shorter route to market.

MTI Wireless Edge Ltd (LON:MWE) said its Mottech Water Solutions subsidiary has launched a new wireless irrigation solution developed for the French wine market. The system, dubbed Tethys, already has a customer list of 200 French vineyards since it is used by four water associations who provide irrigation services to the wine producers. The Tethys water management system enables accurate water distribution and irrigation management, resulting in a 30% increase in crop yields while reducing costs by around 30% from efficient use of water, fertiliser, energy and labour, MTI Wireless noted.

Alien Metals Limited (LON:UFO) has said finalisation of the geophysical review for the Donovan 2 copper-gold project in Mexico is “essentially complete”. The company is hoping to finalise the upcoming drill programme at Donovan 2 at the end of next week. The independent review confirms the company's internal work, providing some priority targets that have the potential to delineate hidden copper-gold mineralisation. The company said it will “push ahead with drill planning” in the third quarter of this year.

OptiBiotix Health PLC (LON:OPTI) said the first half of 2020 saw all of its divisions make progress towards its goal of being profitable this year. The functional fibres division reported a profit during this period, the ProBiotix division was profitable in three of the six months, and the consumer health division was profitable in one of the six months, OptioBiotix told investors. Total invoiced sales of LPLDL and SlimBiome as an ingredient or final product shot up by 398% to £741,504 from £148,818 in the first half of last year.

Instem PLC (LON:INS) said its first-half trading was in line with forecasts with momentum continuing into the second six months of the year. The software group, which has developed and sells packages used to record R&D data, said revenues for the six months ended June 30, 2020, were up 20%, or 12% on a like-for-like basis. Cash generation was strong, leaving Instem with £9.1mln, which when added to the £15.75mln raised earlier this month leaves it with “significant capital” to accelerate its acquisition strategy. It said it has many “potential compelling opportunities” for bolt-on deals, with “more substantial targets” have also been identified.

Gore Street Energy Storage Fund PLC (LON:GSF) has welcomed legal changes to allow battery projects larger than 50Mw in England and 350Mw in Wales. The new legislation removes energy storage, except pumped hydro, from the Nationally Significant Infrastructure Projects regime in England and Wales, said the fund. This will allow larger projects to receive planning permission without government approval.

ANGLE PLC (LON:AGL) said the results of a new study from the University of Southern California (USC), published in the International Journal of Molecular Sciences, have highlighted the “key advantages” of its Parsortix liquid biopsy system compared to a standard of care tissue biopsy. The AIM-listed firm said in addition to the known advantages of a non-invasive, repeatable and low-cost procedure, the USC study showed that “potential actionable therapeutic targets” were found in the Parsortix biopsy that were missed in the tissue biopsy of a single metastatic site.

Karelian Diamond Resources PLC (LON:KDR) has been granted rights of way over the entire Naviskangas private forest road, together with a side road, giving vehicular access to the companys Lahtojoki diamond deposit, the adjacent Lahtojoki South exploration permit area and the surrounding reservation in the Kaavi region of Finland. The granting of vehicular rights of way by the National Land Survey of Finland will facilitate the company in its technical assessment of the Lahtojoki diamond deposit over which it has been granted a mining concession. The two-hectare Lahtojoki diamond deposit is located in the Kaavi region of Eastern Finland and lies in the Karelian Craton which extends across north-eastern Russia and northern Finland.

Mosman Oil And Gas Ltd (LON:MSMN) has updated on its operations, revealing that drilling of the Duff well at the Greater Stanley project will start in the fourth week of July. Additionally, the group said, results of a workover in the Stanley-1 well are expected shortly and preparations are underway for the Falcon-1 well with site works due in late August ahead of drilling in September. The project operator is also planning the proposed Stanley-4 well.

Trident Royalties PLC (LON:TRR) has booked A$903,215 in second quarter royalty payments from the Koolyanobbing iron ore project in Australia. The increased payment is a result of strong iron ore prices, as well as the continued ramp-up of operations at Koolyanobbing. The iron ore price increased significantly over the second quarter, rising by 19% to US$99.4 per tonne from US$83.3 per tonne, with an intra-month peak of US$105.7 per tonne. Whats more, that price trend has continued into the third quarter, with spot prices reaching US$112 per tonne in mid-July.

Bezant Resources PLC (LON:BZT) has completed its due diligence concerning the Hope copper project in Namibia, and the parties are now proceeding to the administrative process of completing the acquisition. As announced on June 19, 2020, the acquisition of 100% of Virgo Resources Ltd and its interests in the Hope copper-gold project in Namibia was subject to certain conditions precedent, including completion of due diligence, regulatory consents for Bezant to proceed, and execution. "The completion of our corporate and technical due diligence on the acquisition of Virgo and its +70% interest in the Hope gold-copper project is an important milestone for Bezant,” executive chairman Colin Bird said in a statement.

Bezant Resources also said its annual general meeting (AGM) will be held at 7/8 Kendrick Mews, South Kensington, London SW7 3HG, England, at 10.00am. on Monday, August 10, 2020. In light of current restrictions on public gatherings and to ensure shareholders can comply with the government measures, the company has concluded that shareholders will not be permitted to attend in person and therefore requests that shareholders cast their votes by proxy 48 hours in advance of the AGM.

Pembridge Resources PLC (LON:PERE) said the Minto copper mine in the Yukon, Canada, which it partially owns, produced 6,820 wet metric tonnes of concentrate during the second quarter of 2020. Payments of US$9.8mln were received by Minto from its major customer Sumitomo, it added. The next shipment to Japan is planned before the end of the third quarter, based on current production levels.

NQ Minerals PLC (AQSE:NQMI) (OTCQB:NQMLF) (OTCQB:NQMIY) said it has appointed Deutsche Gesellschaft für Wertpapieranalyse GmbH (DGWA – the German Institute for Asset and Equity Allocation and Valuation), a mining and resource focused European investment banking boutique, as its Investor and Corporate Relations advisor in Europe. With offices in Frankfurt, Berlin and Vienna as well as representatives in Australia and Canada, NQ said DGWA will focus on the growing interest in mining and exploration within the European financial community due to Europe's considerable investment commitments in the clean energy, electric vehicle and energy storage systems industry.

Alpha Growth PLC (LON:ALGW) said its BlackOak Alpha Growth Fund had seen a significant rise in interest since April though there has been an impact from the coronavirus (COVID-19) disruption. Several major US registered investment advisors, or RIAs, have now moved to the next step of conducting due diligence on the BlackOak fund, it added. Alpha Growth has also started discussions with certain proprietary funds to manage the longevity assets within those funds through separately managed accounts. Longevity assets are life insurance policies sold before the maturity date to a third party for cash.

Canadian Overseas Petroleum Limited (LON:COP) (CSE:XOP) said it has raised £1.3mln in a share placing and has also reached a debt exchange agreement with creditors. The placing investors comprise two Read More – Source

[contf]

[contfnew]

Proactiveinvestors

[contfnewc]

[contfnewc]