A common factor in the recent

demise of Carillion in

the United Kingdom and previously of Abengoa in

Spain was creditor factoring used to bridge liquidity shortfalls. Creditor

factoring generally delays payments to creditors to fund a companys

operations. Such arrangements may help companies in smoothing reported cash

flows in the near term but creates an obligation to pay in the future. However,

if the liquidity problem aggravates in the near term, it turns the clock ticking

down against potential opportunities that could arise in the future.

The lack of transparency in reporting for such arrangements distort cash flow statements which a lot of investors use as a starting point. Unlike economic deterioration in liquidity and use of additional borrowing to firefight the current crisis – financial reporting paints a rosy picture of improving operating cash flows instead of reporting an increase in borrowing.

For investors, the key issue is

to identify at what point in time a trade creditor (included in working capital

changes; i.e., operating cash flows) becomes a financing liability (included in

leverage calculations; i.e., financing cash flows). Current accounting practice

does not specifically cover creditor factoring, and company management can use

it without any specific disclosure requirements. This, however, is vitally

important information for investors to identify in a timely fashion and to

adjust in performance and leverage ratios. An omission to make a timely adjustment

would overstate operating cash flows and understate leverage ratios.

A simple way to understand creditor factoring is considering an example of a cable tv provider. A customer asks to cancel his monthly subscription of £100 as he will be temporarily out of job. The service provider, who does not wish to lose a customer, offers to delay the payment term from paying each month to paying after 6 months (so January subscription is paid on the last day of June). The customer agrees to the extended term and thus improves his monthly net cashflows by saving £100 each month. Until the new payment cycle kicks in, the customer has saved £500 (£600 for 6 months service – £100 payment at the end of 6th month).

However, this in effect is a

debt. When the subscription arrangement eventually ends, the customer will have

to pay £500 to his service provider.

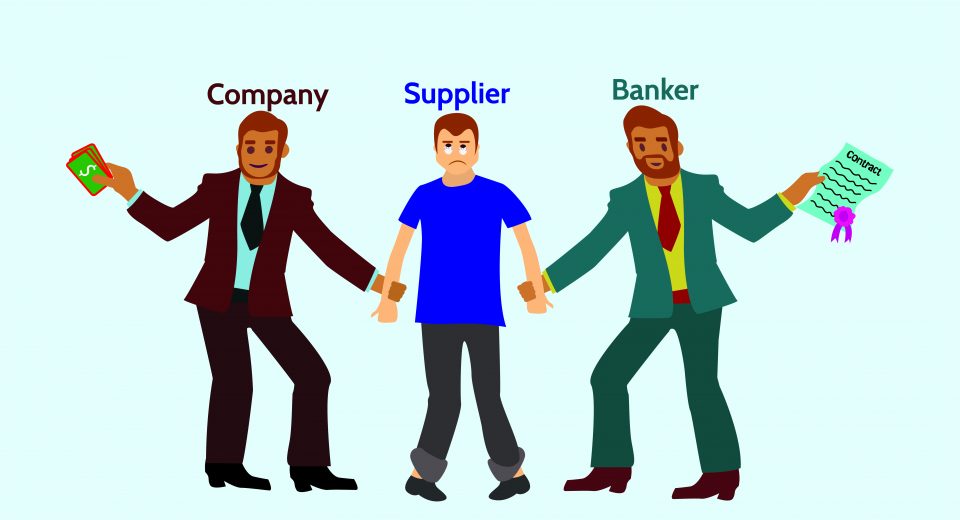

Following this example, lets

assume that a company with strong bargaining power forces a weak supplier to

accept longer credit terms. The company is effectively making the supplier fund

its working capital.

This scenario, however, could

create liquidity problems for the supplier. So, the company uses its banking

relationship to offer its supplier a factoring facility that could be cheaper

and more effective than the suppliers own factoring arrangements. This is an

example of “bad

reverse factoring” which will not show up anywhere in accounts,

except in a lagging bloated account balance of “trade and other creditors.”

Lets stick with this same

example but assume that the supplier has a stronger bargaining power instead of

the company. In this case, the supplier will not agree to an extension of the

payment period or alternatively could force shorter payment periods. Here, the

compRead More